On Twitter, Jason Haas of Tablas Creek shared some of the struggles that wineries have battling consumers’ expectations for cheap or free shipping on wine deliveries.

A short thread on customer expectations and wine shipping. 12 years ago, we surveyed wine club members who had canceled in recent years to learn more about why. One response we got repeatedly was that people expected free or very cheap shipping. https://t.co/JwhKebLKdb 1/

— Jason Haas (@jasonchaas) February 21, 2020

He very justifiably blames Amazon for creating this quagmire. It’s a sentiment that I’m sure most e-commerce businesses would agree with. One recent study from the National Retail Federation found that 75% of respondents in the US expected free shipping–including 88% of Boomers.

And as retailers like Wine.com and Total Wine & More roll out their own free shipping programs, it won’t be only Amazon shaping wine consumers’ expectations.

As I noted in my retweet of Haas’ thread, this has me conflicted. I know that shipping wine is expensive and complicated. There are so many things that wineries and retailers have to consider which businesses shipping books and bed spreads don’t deal with.

But when I take off my “wine biz” glasses and look at how I act as a consumer, I know that I’ve been Amazon’d.

On second thought….maybe not.

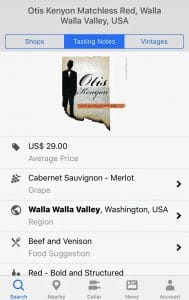

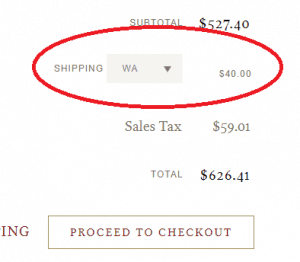

I can’t count how many times I’ve been on a winery’s website picking out items only to go “Whoa” at checkout because of delivery. It’s not that I expect free delivery, but when I see a fee of more than $25-35 (roughly $2-3 a bottle) for a case, I start asking myself, do I really want this wine?

That should make wineries nervous. Because, usually, the answer is going to be “No. I don’t need this wine.”

Up until that point, I was fully onboard spending money and just rolling along with the sale. However, as soon as I was given a reason to pause and wonder if the wines are really worth it, the train derailed.

It’s not because I felt angry or offended that a winery was charging delivery fees–again, I completely understand the business behind it. But what wineries need to understand themselves, is that consumers have so many other choices–not just of different wines and wineries but also of other beverages.

There’s never a situation where we absolutely have to buy your wines. Our lives are not going to be incomplete and joyless without it. In that sense, buying wine (especially online) is always going to be a bit of an impulse purchase. A fleeting fancy carried by a moment of intrigue.

The last thing a winery wants to do is kill that momentum.

Now if I feel this way as a consumer who is reasonably knowledgeable and sympathetic about the tough market wineries face, think about the average consumer who doesn’t know the business. It becomes easy to see why they would expect free delivery or fees far less than the $25-35 that someone like me is comfortable with.

Likewise, it shouldn’t be a shock when e-commerce studies show that upwards of 50% of online baskets are abandoned on the delivery page. While I sincerely hope that cart abandonment numbers are better for wineries, I’m sure even a 30% rate of abandonment cuts deeply into a winery’s sales.

So how much should wineries subsidize shipping?

I don’t think there’s an easy answer to that question. Every winery is going to have its own numbers to crunch. But there’s always going to be a delta between what it costs to ship and how much consumers are willing to pay–and that gap is only going to get larger.

Therefore, I would encourage wineries to add a few more numbers to crunch.

1.) How much are you spending on new customer acquisitions?

So many of my abandoned carts were at wineries that I never tried before. I would come across an article or hear a recommendation that piqued my interest. I’d go check out the website, find other wines that intrigued me and start nibbling the hook. But the difference between reeling in a new customer or having the line break often comes down to how easy it is to get your wines. It doesn’t matter how good the wine is if crappy websites, poor user experience and, yes, delivery fees means that the consumer never tries it. It’s not only a lost sale but also a lost relationship.

Remember, there is always other wine and wineries out there casting their lines. Someone else is going to reel in that customer if you don’t.

2.) How much do you spend to break into a new market?

Many DtC sales are from consumers who can’t find your wine locally. If they’re not going to buy from you directly because of delivery fees, then how much do you need to invest in establishing a presence in their market? This is a big question for West Coast wineries who are looking at the East Coast–which is often the most expensive region to ship to.

Of course, thanks to the asinine three-tier system, even shipping into new markets usually requires licensing, fees and significant investment on top of shipping costs. More numbers to crunch.

3.) But even for the markets that you’re already in, what is the margin difference between a consumer buying 1-2 bottles of your wine retail versus 6-12 online?

Oh I’m definitely going to spend way more than I intended here.

This is one part of the “Amazon Effect” that actually benefits wineries. We’re all really suckers when it comes to free shipping and will spend more to get it.

And I fully admit that I’m one of those suckers. If a website gives me a spending target to get free shipping, I’m usually going to exceed it. Even though I know it’s a placebo and I’m still indirectly paying for shipping, it feels easier to justify the money. Instead of paying an “extra fee”, I’m getting an extra product, so I’m happy.

With wine, a flat rate delivery-fee always encourages me to buy more because I figure if I’m in for a penny, I’m in for a pound. And, hey, if someone else is going to carry the heavy wine bottles to my door, then I might as well buy two cases instead of one!

But if I’m at a wine shop, I’m buying far less. Plus, I’m filling up my basket with other wineries’ wines as well–giving you even less of my wallet.

So can wineries win the delivery cost battle?

In short, no. Consumer expectations for free and cheap delivery are only going to continue to grow stronger. Yes, it’s easy to blame Amazon. But, ultimately, it’s always going to be consumers writing the rules with their wallets.

And while your tactics might need to change, the battle for consumers’ wallets can certainly still be won.