Even if it’s was just a marketing farce of Horace Chase, I still like the story of how Stags’ Leap Winery (and the area) got its name. Jancis Robinson recounts it in her book, American Wine, with the legend of Wappo tribal hunters chasing a stag. The hunt was close until the cunning beast secured its freedom by leaping across a vast chasm among the craggy palisades.

The “Leap” of the Stags Leap District behind Stag’s Leap Wine Cellars.

Kirk Grace, director of vineyard operations for Stag’s Leap Wine Cellars, pointed those fabled peaks out to me when I visited the district on a recent press tour. I thought about those hunters often while tasting through a stellar line-up of Stags Leap District wines.

There’s a lot of great wine here, no doubt. Trophies and treasures abound with a close-knit community of growers and producers. It’s hard to find a bad bottle because they all hold each other accountable for maintaining the area’s reputation.

But even with the bounty of treasures, there is still the urge to hunt.

As I noted in my post, Napa Valley — Boomer or Bust?, there’s a dichotomy brewing in the valley. It’s between what the Boomers (and, to some degree, Gen Xers) want to buy against the boredom that Millennials have with seeing the same ole, same ole everywhere. It’s this boredom that pushes us away from Napa in a hunt for something different.

However, from a business point of view, the current Napa recipe is working spectacularly well right now. Folks are making outstanding Cabs and Chardonnays which Boomers and Gen Xers are gobbling up. Of course, the fact that Cabernet Sauvignon grows really well in Napa Valley helps a lot.

You can’t discount how delicious these Cabs can be. They are, indeed, “dialed in.”

As Doug Shafer of Shafer Vineyards noted, the valley has spent the last 40 years or so dialing things in. They have virtually perfected the art of making exquisite Cabernet. I can’t argue against that. The proof was loud and clear in the many sinfully delicious wines that I had on that trip. It has also been solidified over the years by several bottles that I’ve purchased and enjoyed on my own.

But even with all that velvet-glove gluttony, my Millennial heart was still tempted by another sin.

Lust

A craving for something different. Something exciting. Something worth stringing a bow and sharpening arrows for.

While the stag has gotten fat and easy to cull, I was excited to discover other beasts in the Stags Leap District that would have given the Wappos a good fight. These wines are often made in meager quantities and rarely see the light of retail or restaurant wine lists. Instead, these are the gems hidden in the tasting rooms and wine club offerings. But they are absolutely worth hunting down.

The Steltzner Stags Leap District Sangiovese was so good that a member of our tasting party bought another vintage (2015) to take to dinner.

What was even more remarkable–beyond their existence–is that each of these wines was quintessentially Stags Leap. The family resemblance you see in SLD Cabs of bright, juicy fruit with powerful, yet ripe and forgiving tannins echoes fiercely throughout these wines. Likewise, you can see the same care and “dialed in” attention that Stags Leap producers are known for in each bottle.

Of course, with all that care and the SLD banner comes a hefty price tag. With the average price of land in Napa over $300,000 an acre (and hitting over $400,000 an acre in the Stags Leap District), nothing here is going to be cheap.

Undoubtedly, this is always going to be an area where the Millennial Math is a struggle. However, one of the things that enhances value is excitement and uniqueness.

And you can’t get much more exciting and unique than hunting unicorns.

So let me share with you some of the unicorns I discovered in the Stags Leap District.

Again, I’m not trying to downplay the region’s flagship Cabernets. But trumpets have been heralding their triumphs for decades. If you’re like me, sometimes your ears get enchanted by a different tune. I think each of these wines offers notes worth singing about.

Note: the wines tasted below were samples provided on the press tour.

Steltzner Sangiovese ($55)

I’m going to be writing a dedicated piece on Dick Steltzner in the not too distant future. It’s fascinating how someone who is so ingrained into Stags Leap District history would step out of the parade so many times to do his own thing.

Even though Steltzner’s Cabernet Sauvignon has been prominently featured in iconic bottlings like the inaugural vintage of Joseph Phelps’ Insignia and the 1972 Clos du Val Cabernet Sauvignon (of Judgement of Paris fame), he’s never been afraid to try new things.

The 2016 Steltzner Sangio. Probably my favorite of the two vintages but they were both excellent.

The initial plantings of Steltzner Vineyards in the mid-1960s included Riesling which had been a favorite of Dick Steltzner since he tried Stony Hill’s version. The Riesling didn’t work out, but that didn’t discourage him from experimenting again in the 1980s with adding Merlot, Malbec, Cabernet Franc, Petit Verdot, Pinotage and Sangiovese.

Over the years, Dick Steltzner has gradually parcelled and sold off his vineyard–first in 1990 and most recently in 2012 to the PlumpJack Group. However, he’s kept many of his oldest and favorite plantings including the absolutely delicious Sangiovese as well as some Malbec vines which will occasionally be made as a varietal ($55).

Today, the vineyards are managed by Jim Barbour with the wines made by Mike Smith and Robert Pepi.

The Wine and Verdict

Medium-plus intensity nose. A mix of black cherries and plums. Not as herbal as an Italian example. Instead, there is an intense blue floral component.

On the palate, those dark fruits carry through and are quite juicy with medium-plus acidity. Full-Bodied but not overbearing with ripe medium-plus tannins. As with the Stags Leap District Cabs, the texture and mouthfeel are outstanding. The fruit wraps around your tongue, having a tug of war with the mouthwatering acidity. It makes you want to both hold the wine in your mouth to savor and swallow so you can enjoy another sip. Long finish brings back the floral notes and adds a little oak spice.

Like Villa Ragazzi’s Pope Valley/Oakville Sangioveses, you’re not going to mistake this for a Tuscan wine. But this wine has more than enough character to stand on its own compared to similarly priced Brunellos.

Ilsley Seis Primas ($79)

Not long after Nathan Fay pioneered Cabernet Sauvignon in the Stags Leap District, Robert Mondavi suggested to Ernest Ilsley in 1964 that he try his hand at the variety. The Ilsley Vineyard was already selling their Carignan and Zinfandel to Charles Krug winery. When Robert Mondavi opened his winery a couple of years later, a good chunk of the fruit for his very first Cab came from the young Ilsley vines.

The Ilsleys continue to sell fruit to wineries even after starting their own label in 2000–most notably to Shafer Vineyards where David Ilsley is the vineyard manager. David also manages the family vineyard with brother Ernie running operations and sister Janice handling hospitality and sales. Since 2009, Heather Pyle-Lucas has been making the wines after starting at Robert Mondavi Winery.

Such a delicious bottle. I’m kicking myself for not figuring out a way to bring a few bottles back to Paris.

The 2015 Seis Primas is a blend of 62% Malbec, 24% Cabernet Sauvignon, 12% Merlot and 2% Cabernet Franc with only 183 cases made. The name pays homage to the six girl cousins that make up the 4th generation of the Ilsley family. The wine is sourced from six separate vineyard blocks including a 1996 planting of Malbec that the girls’ grandfather, Ed Ilsley, added to the family estate.

The Wine and Verdict

High-intensity nose. Rich dark blackberry fruit and plum. Lots of blue floral notes of violet and irises. There is also some noticeable oak spice, but it’s not dominating at all.

On the palate, the oak is more noticeable with a chocolate component added to the dark fruit. But still not overwhelming with black pepper spice emerging that compliments the allspice and cinnamon. Full-bodied with high-tannins, the wine is balanced well with medium-plus acidity that keeps the fruit tasting fresh. Long finish lingers on the spices.

I know that I said that it’s hard to find value in the Stags Leap District, but this wine proves me wrong. I’m stunned that this bottle is less than $100. It was easily one of the Top 5 wines that I had that entire week in the Stags Leap District after visiting 15 wineries and trying lots of heavy-hitters.

Honestly, if this wine had the magical “C-word” on the label, it probably could fetch closer to $130. All the Ilsley wines are sold direct-to-consumer. If you want any chance of bagging this trophy, you need to visit this family winery.

Clos du Val Cabernet Franc ($100)

The 2016 Clos du Val Cabernet Franc. Still young but impressive already.

Even among Stags Leap District Cabernet Sauvignons, Clos du Val is a unicorn. From founding winemaker Bernard Portet to current winemaker Ted Henry and assistant Mabel Ojeda, tasting a Clos du Val Cab stands out from the pack. While the use of new French oak has steadily increased over the years (100% for their 2015 Hirondelle estate), it’s never been as overt as it is with many of their Napa brethren.

With lively acid and more moderate alcohols, these are always wines that sing in harmony with food. Think Stevie Nicks and Tom Petty’s “Stop Draggin’ My Heart Around.” Yeah, Fleetwood Mac and the Heartbreakers are great–just like a big, bold, luscious Napa Cab is at times. But, damn, if there’s not something magical about tension and style.

These are also wines built for aging. That’s why it wasn’t shocking that when the historic 1976 Judgement of Paris wine tasting was recreated in 1986, it saw the 1972 Clos du Val Cab nab first place.

The Cabernet Franc comes from the estate Hirondelle Vineyard that surrounds the winery. It’s named after the French word for “swallows” and references the birds that build their nests on the northwest side of the winery every spring. The 2016 vintage was 99% Cabernet Franc with 1% Cabernet Sauvignon. Clos du Val’s winemaking team aged the wine 20 months in a mix of 80% new French and Hungarian oak.

The Wine and Verdict

Some of the swallows and nests that give the Hirondelle Vineyard its name.

High-intensity nose. Very floral but also an earthy, leather component. Underneath there is some dark fruit of blueberries and blackberries, but they’re secondary notes in this very evocative bouquet.

On the palate, the fruit makes its presence more known and are amplified by high acidity. Very mouthwatering. The earthy, leathery notes are still here but add a truffle component. It’s not like a Rhone, but it’s almost meaty. Firm, medium-plus tannins have solid structure but are still approachable. Moderate length finish brings backs the floral notes.

This is definitely a completely different Cabernet Franc than anything you would see in the Loire. It’s also not as “Cab Sauv-like” as many new world examples of Cabernet Franc can be (especially in Napa and Washington). The wine is certainly its own beast and is bursting with character. I can only imagine how much more depth and complexity this wine will get with age.

At $100 a bottle, you’re paying top-shelf Cab prices for it. But I guarantee this wine is going to have you scribbling a lot more tasting notes and descriptors than your typical $100+ Napa Cab.

Quixote Malbec ($80)

Or step into the shower they have in the visitor’s bathroom at the Quixote tasting room.

Quixote is pretty much the Narnia of Napa Valley. If you want to find unicorns, all you need to do is enter through the Friedensreich Hundertwasser-designed wardrobe and there you are.

Carl Doumani founded Quixote in 1996 not long before he sold Stags’ Leap Winery to Beringer (now Treasury Wine Estates). At Stags’ Leap, Doumani built a reputation for the high quality of his Petite Sirah. When he sold the property, he kept many of the choice parcels for his new venture. The current owners, the Chinese private firm Le Melange, which acquired Quixote in 2014, continues to make Petite Sirah a significant focus.

They make three tiers of Petite Sirah. The prices range from the red label Panza ($50) up to their premier black label Helmet of Mambrino ($105-125 depending on the vintage). Quixote also makes a very charming rose of Petite Sirah ($35). All of those are well worth trying. However, the one wine that really knocked my socks off was their Stags Leap Malbec.

Doumani fell in love with the grape after a trip to Argentina in the 2000s. He had a little less than an acre planted with the first vintage released in 2011. Only around 100-150 cases of this wine are produced each year.

The Wine and Verdict

The 2015 Quixote Stags Leap Malbec.

Medium-plus intensity nose. Blackberries clearly dominate the show with some noticeable chocolatey oak undertones. With a little air comes black pepper spice, anise and savory leather notes.

On the palate, this was one of the most quintessential Stags Leap wines I tasted. Totally “iron fist in a velvet glove” all the way. Very full-bodied with ripe, medium-plus tannins. The plush texture is accentuated by the creamy vanilla of the oak. Medium acidity gives enough balance to add juiciness to the blackberries and also highlight a red plum component. Moderate finish brings back the spice notes with the black licorice note lingering the most.

In many ways, I can see regular consumers (as opposed to blind tasters) thinking this was a Napa Cab. There’s the rich dark fruit with noticeable oak. Coupled with the full-bodied structure and mouthfeel, it hits all those hedonistic notes that many consumers seek out in top-shelf Napa wines. But I love what the Malbec-y spice brings to the table. It helps the wine stand apart as a unicorn worth seeking out.

It’s definitely different than Malbecs grown elsewhere in the world (and a lot pricier too). However, this is truly a unique expression of the grape that reflects the Stags Leap District exceedingly well.

Other Stags Leap District Unicorns that I haven’t had yet but am on the hunt for.

In 2014, Decanter magazine noted that the Stags Leap District was planted to 80% Cabernet Sauvignon, 15% Merlot, 2% Cabernet Franc, 2% Petite Sirah and 1% other. I honestly don’t think the numbers have changed much in the last five years. If anything, Cab has probably gained more ground and relegated Cabernet Franc and Petite Sirah to the One-Percenter Club.

So, yeah, these wines are going to be hard to fine. But my experiences with the unicorns that I’ve already encountered has me feeling that these are going to be worth the hunt.

Chimney Rock Cabernet Franc ($85)

Yup. Totally fangirl’d.

I fully admit that I’m an Elizabeth Vianna fangirl. I adore her work at Chimney Rock and she also has a great twitter account worth following. Another upcoming post in the works will see me getting geeky over Chimney Rock’s crazy delicious Elevage Blanc.

From a solely Stags Leap perspective, this Cabernet Franc from their estate vineyard intrigues me. Even though Chimney Rock’s vineyards essentially encircles Clos du Val’s Hirondelle vineyard, I suspect that this will be a very different expression of Cabernet Franc. That’s partly why it would be so cool to try.

Chimney Rock also occasionally releases a rose of Cabernet Franc as well as a varietal Sauvignon gris– when the latter is not being used up in their Elevage blanc.

Update: Oh and there’s now this to look forward to!

We bottled our first commercial version of that wine this year! We will have a 2018 Stags Leap District Fiano! Only 23 cases produced but it’s pretty fun wine!

— Elizabeth Vianna (@ChimneyRockWine) July 20, 2019

Yes! A Stags Leap District Fiano!

Pine Ridge Petit Verdot ($75)

While founded and based in the Stags Leap District, Pine Ridge sources fruit from many places and has estate vineyards in Carneros, Howell Mountain, Rutherford and Oakville.

Founded by Gary Andrus in 1978 and now owned by the Crimson Wine Group, Pine Ridge was also a big player in getting the Stags Leap District established as an AVA. While the winery is well-known for its Chenin blanc-Viognier blend (sourced mostly from the Clarksburg AVA in Sacramento, Solano and Yolo counties), the bread and butter of Pine Ridge’s Stags Leap estate is, of course, their Cab.

That’s what makes trying this Petit Verdot so intriguing even though a small amount comes from their Oakville property. Petit Verdot is a late-ripening variety that is seeing increased interest across the globe. It’s being planted more to help offset the toll that climate change is having on overripe Cab & Merlot. Of course, it can be a finicky grape to make as a varietal. However, when it’s done well, it’s a spicy delight!

Regusci Zinfandel ($60)

If you want to listen to a great podcast, check out Doug Shafer’s interview with Jim Regusci.

The Regusci family has a tremendous history in Napa Valley beginning with the site of the very first dedicated winery built in the Stags Leap District. The stone building, constructed by Terrill Grigsby in 1878, was known as the Occidental Winery for many years.

In 1932, Gaetano Regusci acquired the property and planted Zinfandel with many of those vines still producing fruit today. The family would sell grapes and maintain a dairy ranch on the property for several decades. In 1996, Gaetano’s son and grandson, Angelo and Jim Regusci, started the Regusci Winery.

While Zinfandel has a long history in Napa, its numbers are slowly dwindling. That’s a shame because Zinfandel is the “Craft Beer” of American Wine and a grape that is poised to capture Millennials’ attention. I don’t think anyone else in the Stags Leap District is still growing the grape which certainly makes this a fun unicorn to find.

Stags’ Leap Winery Ne Cede Malis ($150)

I became fascinated with this wine when I attended a winemaker’s dinner last year with Stags’ Leap Winery’s winemaker Joanne Wing.

Stags’ Leap Winery Winemaker Joanne Wing.

Sourced from a tiny Prohibition-era block of vines, Ne Cede Malis is a field blend. Mostly Petite Sirah with up to 15 other different grapes including Sauvignon blanc, an unknown Muscat variety, Carignane, Mourvedre, Grenache, Peloursin, Cinsault, Malbec and Syrah. The grapes are all harvested together and co-fermented.

Coming from the Latin family motto of Horace Chase, Ne Cede Malis means “Don’t give in to misfortune.” But with the last vintage of Ne Cede Malis on Wine-Searcher being 2015 (Ave price $86), I do fret that maybe these old vines came into some misfortune. If any of my readers know differently, do leave a comment. (UPDATE BELOW)

Of course, that is the risk that comes with all unicorns. One day they may simply cease to exist. But that is also part of the thrill of the hunt.

Sometimes you bag your prize. Other times you’re standing on the edge of a cliff watching it leap away.

UPDATE: The Ne Cede Malis lives on! I was very excited to get an email from Stags’ Leap Winery letting me know that these old vines are still going strong with the 2016 vintage slated to be released in the fall for a suggested retail of $150. Only around 500 cases were produced so this is still a unicorn worth hunting!

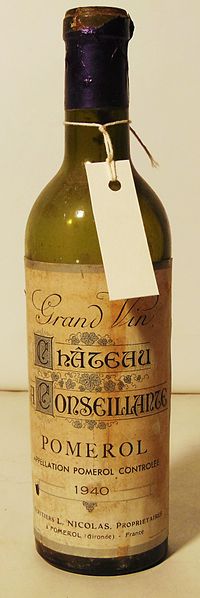

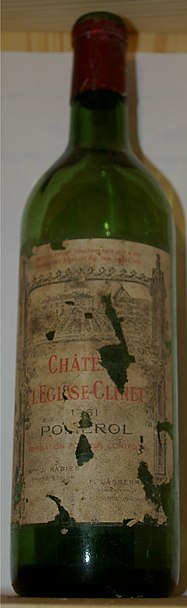

We are in the home stretch of our series on the 2017 Bordeaux Futures campaign with only a few more offers left to review.

We are in the home stretch of our series on the 2017 Bordeaux Futures campaign with only a few more offers left to review.