We are in the home stretch of our series on the 2017 Bordeaux Futures campaign with only a few more offers left to review.

We are in the home stretch of our series on the 2017 Bordeaux Futures campaign with only a few more offers left to review.

Today we’re making our second to last stop in Margaux to review the offers of the 3rd Growths Ch. Kirwan, d’Issan and Giscours as well as the 2nd Growth Brane-Cantenac.

In our previous visits to the commune we explored the offers of Marquis d’Alesme, Malescot-St.-Exupéry, Prieuré-Lichine, Lascombes and Cantenac-Brown as well as that of Ch. Palmer.

You can check out the links at the bottom to see other offers from across Bordeaux which we have reviewed so far in this series.

Ch. Kirwan (Margaux)

Some Geekery:

The origins of Kirwan date back to the 17th century when the land belonged to the noble de Lassalle family. In 1710, the Bordeaux negociant Sir John Collingwood bought the property which eventually passed as a dowry to his daughter when she married an Irishman from Galway named Mark Kirwan.

In 1780, Thomas Jefferson visited the estate on his tour of Bordeaux and ranked the wines of Kirwan as a “2nd Growth” behind his ranking of First Growths Latour, Lafite, Margaux and Haut-Brion.

Label of Chateau Kirwan featuring the Chateau and the portraits of Armand and Jean-Henri Schÿler

After Mark Kirwan passed away in the early 19th century, the estate went through a succession of owners until it family came into the hands of Camille Godard, the mayor of Bordeaux. In 1882, Godard bequeathed the estate to the City of Bordeaux who contracted the negociant firm Schröder & Schÿler to manage the property.

By 1925, the Schÿler family had purchased Ch. Kirwan outright. The property is still in the hands of family today with Nathalie Schÿler managing.

In 1991, the Schÿlers brought Michel Rolland in to consult. Prior to this, Rolland had worked almost exclusively with clients on the Right Bank making Kirwan his first foray into the Haut-Medoc. He quickly made several substantial changes, insisting on lower yields and more strict selections with the creation of a second wine, Les Charmes de Kirwan, to help limit the fruit that would go into the Grand Vin. Since 2002, all the fermentation have been done via native wild ferments.

Ch. Kirwan is unique among the classified growths with virtually all of its 40 ha (99 acres) vineyards being the same as they were during the 1855 classifications with only slight changes in the cépage assortment. Today the vineyards are planted to 45% Cabernet Sauvignon, 30% Merlot, 15% Cabernet Franc, 10% Petit Verdot and a little bit of experimental Carménère.

Over the years the amount of Cabernet Franc has decreased (and replaced with Cabernet Sauvignon) but Kirwan still has one of the highest percentages of Cabernet Franc and Petit Verdot planted in the Medoc. Most of the Cabernet varieties are found on the deep gravelly-sand soils of the Cantenac plateau while the Merlot thrives on the more clay and limestone-based soils on the western side of the Margaux commune near Arsac.

The 2017 vintage is a blend of 55% Cabernet Sauvignon, 30% Merlot, 10% Cabernet Franc and 5% Petit Verdot. Around 16,000 cases a year are produced.

Critic Scores:

93-95 Wine Enthusiast (WE), 90-92 Wine Advocate (WA), 89-92 Wine Spectator (WS), 89-91 Vinous Media (VM), 89-90 James Suckling (JS), 90-92 Jeb Dunnuck (JD), 88-89 Jeff Leve (JL)

Sample Review:

This is well extracted, with dark berry fruits, attractive tobacco leaf and charcoal notes. It has that same savoury frame that so many from Margaux have this year, and the fruit character is not bursting with generosity but is still expressive and lyrical. It really does offer something for those looking for a more sculpted wine. Medium term drinking. (91 points) — Jane Anson, Decanter

Offers:

Wine Searcher 2017 Average: $45

JJ Buckley: No offers yet.

Vinfolio: No offers yet.

Spectrum Wine Auctions: No offers yet.

Total Wine: $45.97 (no shipping with wines sent to local Total Wine store for pick up)

K&L: $46.99 + shipping (no shipping if picked up at 1 of 3 K & L locations in California)

Previous Vintages:

2016 Wine Searcher Ave: $47 Average Critic Score: 92 points

2015 Wine Searcher Ave: $56 Average Critic Score: 92

2014 Wine Searcher Ave: $46 Average Critic Score: 91

2013 Wine Searcher Ave: $43 Average Critic Score: 89

Buy or Pass?

Merlot berries being sorted at Ch. Kirwan during the 2010 harvest.

Kirwan has been charming the pants off of me since the 2009 vintage (WS Ave $79). Both the 2012 (WS Ave $55) and 2014 vintage were released in the mid $40s and offered stellar value for the quality they delivered. Even the troublesome 2011 (WA Ave $54) and 2013 vintages of Kirwan drank way above their similarly priced peers with the former starting to see a steady price bump as more folks have catched on.

That personal track record of producing a savory, yet elegant style which hits my pleasure spots as well as pricing which fits perfectly in line with the 2014 vintage makes this a Buy for me.

Even though it looks like most critics have been poo-pooing this years release, this is a case where I’m going to go with my gut and past experience instead of numerical scores.

Ch. d’Issan (Margaux)

Some Geekery:

Engraved above the door in the entryway to Ch. d’Issan is the estate’s Latin motto–Regum Mensis Arisque Deorum “For the tables of kings and the altars of the gods”–which pays tribute to the property’s long history and presence on the tables of royal families throughout Europe.

Legend has it that wine from the vineyards of d’Issan were served at the wedding banquet of Eleanor of Aquitaine and King Henri II in 1152.

Clive Coates notes in Grand Vins that following their defeat at the Battle of Castillon in 1453, the English Army made their last stand at d’Issan. At the conclusion of the Hundred Years War, the property was granted as a reward by King Charles VII to the Comte de Foix for his service is fighting the English.

Centuries later the wines of d’Issan were well stocked in the cellars of the Prince of Wales (later George II) along with those of Latour, Lafite, Margaux and Pontac (Haut-Brion). While serving as the Ambassador to France, future US President Jefferson ranked the estate (then known as Ch. Candale) as a “3rd Growth” following his tour of the wineries of Bordeaux. In the 19th century, the favorite claret of Emperor Franz Joseph I of Austria was reportedly Ch. d’Issan.

When Thomas Jefferson visited the estate in 1780, he ranked the wines Ch. Candale (named after its then owners) as a 3rd Growth–a ranking that would later be affirmed in the official 1855 Classification done by the Bordeaux Chamber of Commerce.

The estate gets its name from its time under the ownership of the 17th century French knight Pierre d’Essenault who acquired the estate as a dowry with his descendants running it till 1760.

The modern history of the estate began after World War II when it was purchased by the Cruse family who also owned the 2nd Growth Ch. Rauzan-Ségla. The Cruses eventually sold Rauzan-Ségla in 1956 to focus completely on d’Issan.

The estate is still managed today by the Cruse family however, in 2013, Jacky Lorenzetti acquired a 50% stake in the ownership of d’Issan to go along with his holdings of Ch. Lilian Ladouys in St. Estephe and Ch. Pedesclaux in Pauillac.

When the estate was officially classified as a 3rd Growth in 1855, the vineyards were planted almost entirely to the obscure variety Tarney Coulant (also known as Mancin). Today the 44 ha (109 acres) of d’Issan vineyards are planted to 60% Cabernet Sauvignon and 40% Merlot with the percentage of Merlot increasing in recent years.

The 2017 vintage is a blend of 65% Cabernet Sauvignon and 35% Merlot. Around 6000 cases a year are produced.

Critic Scores:

93-94 JS, 90-92 WA, 89-92 VM, 92-94 JL, 89-91 JD

Sample Review:

The 2017 d’Issan is plump, juicy and forward. There is lovely depth and texture to the 2017, but without the explosive energy that has characterized some recent vintages, including the 2015 and 2016. Plush fruit, silky and soft tannins all add to the wine’s considerable appeal. I expect the 2017 will drink well with minimal cellaring. In 2017, d’Issan is a wine of finesse, persistence and nuance rather than power. The blend is 65% Cabernet Sauvignon and 35% Merlot. Harvest started on September 18, the earliest since 2003. Quite unusually, there was no break in between the picking of the Merlot and Cabernet Sauvignon. Indeed, some of the younger vine Cabernet came in before all the Merlots were in. Tasted four times. — Antonio Galloni, Vinous

Offers:

Wine Searcher 2017 Average: $60

JJ Buckley: $61.94 + shipping (no shipping if picked up at Oakland location)

Vinfolio: No offers yet.

Spectrum Wine Auctions: No offers yet.

Total Wine: $59.97

K&L: $59.99 + shipping

Previous Vintages:

2016 Wine Searcher Ave: $71 Average Critic Score: 93 points

2015 Wine Searcher Ave: $76 Average Critic Score: 93

2014 Wine Searcher Ave: $63 Average Critic Score: 92

2013 Wine Searcher Ave: $51 Average Critic Score: 89

Buy or Pass?

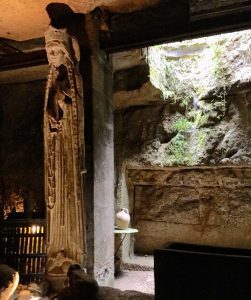

The castle looking chateau of d’Issan.

The history geek in me absolutely adores the story of d’Issan. But I’ve only have had tasting experiences with a couple of vintages of d’Issan–both stellar years (2005 WS Ave $119 and 2009 WS Ave $95). While its relatively easy to make good wines in vintages like those, I find that the mettle of an estate shines in the more average to sub-par vintage.

So while I love the story, without having a bearing on what the d’Issan team can do in vintages like 2017 or poorer, I’m not inclined to gamble on their 2017 offer. Pass.

Ch. Brane-Cantenac (Margaux)

Some Geekery:

Founded in the 18th century as Domaine Guilhem Hosten and later known as Chateau Gorce-Guy, Brane-Cantenac received its current name when it was purchased in 1833 by Baron Hector de Brane, known as “the Napoléon of the Vineyards”. To finance the sale, Brane sold his Pauillac estate Brane-Mouton (later known as Mouton-Rothschild). The “Cantenac” comes from the plateau that the estate’s 75 ha (185 acres) are located on.

In 1866, Brane-Cantenac came under the ownership of the Roy family who also owned neighboring d’Issan. Under the Roys the estate would fetch among the highest prices of all the classified 2nd growths with some vintages being on par with the pricing of the First Growths.

The modern history of Brane-Cantenac began in 1920 when it was purchased by the consortium behind the Societe des Grands Crus de France that also owned Ch. Margaux and Ch. Giscours as well as Chateau Lagrange in St. Julien. Among the shareholders were Léonce Recapet and his son-in-law, François Lurton. After dissolution of the consortium in 1925, Recapet and Lurton purchased Brane-Cantenac with the estate later passing to François’ son, Lucien.

Lucien Lurton would go on to acquire several estates that he turned over into the care of his 10 children in the 1990s. His son, Henri Lurton, took control of Brane-Cantenac in 1992.

While mostly traditional in style, Brane-Cantenac was one of the first in Bordeaux to adopt the use of the use of an optical sorter during harvest and in some vintages will make use of a reverse osmosis machine–mostly in rainy vintages to remove excess water that has swelled the grapes.

The author and Henri Lurton at the 2016 UGC tasting featuring the wines of the 2013 vintage.

Around 25% of Brane Cantenac is farmed organically with only ploughing and organic manure used throughout all the vineyards. Additionally 12 ha (20 acres) are farmed bioydnamically.

The 2017 vintage is a blend of 74% Cabernet Sauvignon, 21% Merlot, 4% Cabernet Franc and 1% Petit Verdot with this vintage being the first vintage to include Petit Verdot in the final blend. Around 11,000 cases a year are produced. In 2017, most of that year’s frost hit the portion of vineyards usually allocated towards production of the estate’s second wine, Baron de Brane.

Critic Scores:

94-96 WE, 92-93 JS, 91-93 VM, 88-91 WS, 89-92 JD, 91-94 JL

Sample Review:

The 2017 Brane-Cantenac was picked from 14 September to 2 October at 31.2hl/ha after frost destroyed 35% of the vines in April. It is matured in 75% new oak and 25% one-year old and it has 13% alcohol. It has a tightly wound bouquet with broody black fruit, tar and a touch of graphite, very Pauillac in style as usual. The palate is medium-bodied with fine tannin, very linear and precise, not a deep Margaux and unashamedly classic in style with dry, slightly brusque tannin. The finish is dominated by tobacco and pencil lead notes with healthy pinch of pepper on the aftertaste. Classic Brane-Cantenac through and through. Tasted on three occasions. — Neal Martin, Vinous

Offers:

Wine Searcher 2017 Average: $64

JJ Buckley: No offers yet.

Vinfolio: No offers yet.

Spectrum Wine Auctions: $413.94 for minimum 6 bottles + shipping (no shipping if picked up at Tustin, CA location)

Total Wine: $69.97

K&L: $66.99 + shipping

Previous Vintages:

2016 Wine Searcher Ave: $75 Average Critic Score: 93 points

2015 Wine Searcher Ave: $80 Average Critic Score: 94

2014 Wine Searcher Ave: $60 Average Critic Score: 92

2013 Wine Searcher Ave: $56 Average Critic Score: 90

Buy or Pass?

Describing Brane-Cantenac as the “Pauillac of Margaux” is a spot-on description. Outside of the top estates of Ch. Margaux and Ch. Palmer, no one else in the communes makes a more structured and age-worthy Margaux than Brane-Cantenac. Compared to its 2nd Growth peers and even the highly esteemed Pauillac 5th Growths Lynch-Bages and Pontet-Canet, Brane-Cantenac is often vastly underpriced for its quality level.

However, it is that highly structured and exceptionally age-worthy style which causes me to avoid Brane-Cantenac in vintages like 2017 when I’m looking for more shorter term “cellar defender” wines. While the estate is a stellar buy in cellar-worthy vintages like 2009/2010 and 2015/2017, it doesn’t fit the bill on what I’m looking right now so Pass.

Ch. Giscours (Margaux)

Some Geekery:

While the origins of Giscours goes back to the 14th century, the first documentation of winemaking at the property dates to 1552. In the 18th century, the estate was owned by the Marquis de St. Simon whose family saw the government confiscate Giscours during the French Revolution.

The property was sold in 1793 to two Americans, John Gray and Jonathan Davis. Eventually Giscours was acquired in 1845 by a Parisian banker, the Comte de Pescatore, who hired Pierre Skawinski to manage the property.

The exterior of Ch. Giscours.

Over the next 50 years, Skawinski would go on to develop many innovations in the vineyard and winery including the design of a new plow as well as the use of sulfur spray to combat powdery mildew. He also developed techniques of gravity flow winemaking at Giscours that his sons would later take to other notable Bordeaux estates like Léoville-Las Cases, Lynch-Bages and Pontet-Canet.

In 1875, Giscours was purchased by the Cruse family who had their hand in the ownership of several Bordeaux properties. They sold the estate in 1913. By 1952, Giscours came under the ownership of an Algerian vigneron, Nicolas Tari. In 1976, Tari’s son, Pierre, was one of the judges at the famous “Judgement of Paris” wine tasting in 1976.

Today Giscours is owned by Eric Albada Jelgersma who also owns the 5th Growth Margaux estate Chateau du Tertre, the Haut-Medoc estates Ch. Duthil and Ch. Houringe as well as the Tuscan estate of Caiarossa.

In 1995, Alexander van Beek was brought in to manage the estate and is credited with taking Giscours (as well as du Tertre) to new heights of success.

All the vineyards are sustainably managed with 20% farmed biodynamically.

The 2017 vintage is a blend of 71% Cabernet Sauvignon, 24% Merlot and 5% Petit Verdot. Around 25,000 cases a year are produced.

Critic Scores:

94-96 WE, 92-93 JS, 90-93 VM, 90-92 WA, 89-92 WS, 92-94 JL, 89-91 JD

Sample Review:

An up and coming Margaux estate, the 2017 Château Giscours offers a complex bouquet of sandalwood, damp flowers, sous bois, and spicy red fruits. It’s slightly stretched and firm on the palate, with medium-bodied richness. I’d like to see more fat and texture here, but I suspect it will put on more weight with time in barrel and bottle. It should drink nicely for a decade. — Jeb Dunnuck, JebDunnuck.com

Offers:

Wine Searcher 2017 Average: $59

JJ Buckley: $60.94

Vinfolio: No offers yet.

Spectrum Wine Auctions: $365.94 for minimum 6 bottles + shipping

Total Wine: $59.97

K&L: $59.99 + shipping

Previous Vintages:

2016 Wine Searcher Ave: $68 Average Critic Score: 93 points

2015 Wine Searcher Ave: $72 Average Critic Score: 93

2014 Wine Searcher Ave: $67 Average Critic Score: 91

2013 Wine Searcher Ave: $52 Average Critic Score: 90

Buy or Pass?

The 2005 Giscours is such a beauty but even in sub-par vintages Giscours has been producing winners that over deliver for the price of a 3rd Growth.

Probably one of the best buys in Bordeaux is the 2005 Giscours (WS Ave $102). This is a wine that is drinking at its peak now and is easily outshining wines almost twice its price. I’ve been fortunate to enjoy this wine several times with a few bottles still left in the cellar.

Likewise the 2012 (WS Ave $75) and 2014 are still punching above their weight though both were closer to $55 when they were released. It’s been clear for sometime that Giscours has been an estate on the ascent but, sadly for our wallets, the prices are starting to catch up with its stellar quality level.

That makes seeing a 2017 future offer below 2014 levels quite surprising. While I doubt the price of the 2017 will reach into the $70s, it’s far more likely that the wine will be closer to 2014 by the time this wine hits the shelf in 2020. It’s worth it to Buy now and lock in the futures price.

More Posts About the 2017 Bordeaux Futures Campaign

*Bordeaux Futures 2017 — Langoa Barton, La Lagune, Barde-Haut, Branaire-Ducru

*Bordeaux Futures 2017 — Pape Clément, Ormes de Pez, Marquis d’Alesme, Malartic-Lagraviere

*Bordeaux Futures 2017 — Lynch-Bages, d’Armailhac, Clerc-Milon and Duhart-Milon

*Bordeaux Futures 2017 — Clos de l’Oratoire, Monbousquet, Quinault l’Enclos, Fonplegade

*Bordeaux Futures 2017 — Cos d’Estournel, Les Pagodes des Cos, Phélan Ségur, Calon-Segur

*Bordeaux Futures 2017 — Clinet, Clos L’Eglise, L’Evangile, Nenin

*Bordeaux Futures 2017 — Malescot-St.-Exupéry, Prieuré-Lichine, Lascombes, Cantenac-Brown

*Bordeaux Futures 2017 — Beychevelle, Talbot, Clos du Marquis, Gloria

*Bordeaux Futures 2017 — Beau-Séjour Bécot, Canon-la-Gaffelière, Canon, La Dominique

*Bordeaux Futures 2017 — Vieux Chateau Certan, La Conseillante, La Violette, L’Eglise Clinet

*Bordeaux Futures 2017 — Montrose, La Dame de Montrose, Cantemerle, d’Aiguilhe

*Bordeaux Futures 2017 — Clos Fourtet, Larcis Ducasse, Pavie Macquin, Beauséjour Duffau-Lagarrosse

After checking out some of the 2017 offers

After checking out some of the 2017 offers

We are heading to Margaux as we continue our exploration of the 2017 Bordeaux Futures campaign.

We are heading to Margaux as we continue our exploration of the 2017 Bordeaux Futures campaign.