We head to St. Estephe for the next installment in our series on the 2017 Bordeaux Futures campaign to look at offers for the 2nd Growth estate of Cos d’Estournel and its second wine, Les Pagodes des Cos, the cru bourgeois Ch. Phélan Ségur and the 3rd Growth Calon-Segur.

Be sure to check out previous posts in our series for more details about the 2017 vintage.

*Bordeaux Futures 2017 — Palmer, Valandraud, Fombrauge, Haut-Batailley

*Bordeaux Futures 2017 — Clos de l’Oratoire, Monbousquet, Quinault l’Enclos, Fonplegade

Now onto the offers.

Ch. Cos d’Estournel (St. Estephe)

Some Geekery:

Since its founding in 1811 by Louis Gaspard d’Estournel, Cos d’Estournel has always been a little bit of a rule breaker. The chateau was also one of the first in Bordeaux to estate bottle and instead of selling wine through the traditional courtier and negociant system, Gaspard sold his wine directly to clients across the globe–with India being a key market.

Vineyards of Cos d’Estournel in St. Estephe

However, this early rebellious streak came to an end in 1852 at the death of Gaspard which was somewhat beneficial as by the time the fame 1855 Classification was drafted, the brokers and negociants who helped crafted the classification had some pricing records to know where to place Cos d’Estournel. With these records, Cos d’Estournel was able to take its place as a 2nd Growth along with Ch. Montrose in St. Estephe.

Compare this to the story of the Haut-Medoc 5th Growth Ch. Cantemerle whose owner bypassed the Bordelais system to sell directly to Dutch merchants. After initially being omitted from the original classification, it took almost a year of lobbying, producing sales and pricing records, by Mme. De Villeneuve-Durfort to convince the Bordeaux Brokers’ Union that Cantemerle merited inclusion.

For a time, Cos d’Estournel was owned by the Charmolue family who also owned neighboring Montrose but by 1917 it came under the care of Fernand Ginestet whose grandson, Bruno Prats, would usher in the modern-era of success for the estate. Eventually the Prats sold Cos d’Estournel to the Merlaut family (owners of Chasse-Spleen, Haut-Bages Libéral, Gruaud-Larose among many others) in 1998 who quickly sold it two years later to Michel Reybier.

To insure continuity, Reybier hired the son of Bruno Prats, Jean-Guillaume, to manage the estate which he did till 2012 when he left to join Louis Vuitton Moët Hennessy (LVMH). During his time, he completely renovated the winery by removing all pumps and making everything gravity fed. To minimize some of the harsh tannins associated with the cooler and more clay dominant soils of St. Estephe, Cos d’Estournel was also an early adopter of completely destemming clusters even during very ripe vintages like 2009. Prats’ replacement, Aymeric de Gironde, lasted 5 years until the 2017 when Reybier himself took over managing the estate.

The 2017 vintage is a blend of 66% Cabernet Sauvignon, 32% Merlot, 1% Petit Verdot and 1% Cabernet Franc.

Critic Scores:

97-100 Wine Advocate (WA), 97-98 James Suckling (JS), 95-97 Wine Enthusiast (WE), 94-96 Vinous Media (VM), 94-96 Jeb Dunnuck (JD), 96-98 Jeff Leve (JL)

Sample Review:

This is exceptional, if a touch below the intensity and harmony of 2016. I love the density that’s displayed in this wine, showcasing luxurious, well-enrobed tannins. The complexity steals up on you little by little, the dark cassis and plum fruit character deepening through the palate with flashes of sage, charcoal, cigar box, graphite and taut tannins. The colour difference is marked between the grand vin and second wine, with the Cos extremely deep damson in colour following a one-month maceration at 30 degrees and clever use of the press. Harvested 12- 30 September. 40% of production went into the grand vin. (94 points) Jane Anson, Decanter

Offers:

Wine Searcher 2017 Average $148

JJ Buckley: $154.94 + shipping (no shipping if picked up at Oakland location)

Vinfolio: $154 + shipping

Spectrum Wine Auctions: $899.94 for minimum 6 pack + shipping (no shipping if picked up at Tustin, CA location)

Total Wine: $149.97 (no shipping with wines sent to local Total Wine store for pick up)

K & L: $144.99 + shipping (no shipping if picked up at 1 of 3 K & L locations in California)

Previous Vintages:

2016 — Wine Searcher Ave. $192 Average Critic Score: 94 points

2015 — Wine Searcher Ave. $190 Average Critic Score: 95

2014 — Wine Searcher Ave. $138 Average Critic Score: 94

2013 — Wine Searcher Ave. $134 Average Critic Score: 91

Buy or Pass?

As I’ve outlined several times in this series, I have no interest in paying 2015/2016 prices for a vintage that I would put more on par with 2014. I understand that with drastically reduced yields, there is going to be some pressure on prices due to limited supply but from everything I’ve read about this vintage, the quality just doesn’t seem to merit paying a premium.

To that extent, I find the pricing of the 2017 Cos d’Estournel at around $148 a bottle to be quite fair and tempting. My only hedge is the changing management style from Prats to de Gironde to now owner Michel Reybier taking a more hands on approach. While I’ve absolutely adored the 2005-2006 and 2008-2010 Cos d’Estournel of Prats, I was a little underwhelmed by the 2014 vintage but I didn’t want to judge too harshly on that vintage at such a young age. While I have no doubt that Reybier is driven by a stellar commitment to quality, I just don’t know if his style is going to match my personal tastes and when I’m looking at wines north of $100, I want to bank on more certainty than glowing critic scores.

So for me, the 2017 Cos d’Estournel is a Pass but it will certainly be a compelling buy for many Bordeaux lovers.

Les Pagodes des Cos (St. Estephe)

Some Geekery:

The second wine of Cos d’Estournel, Les Pagodes des Cos was first produced in 1994. Sourced from young vines and declassified lots, it originally replaced the role of the Prat’s family cru bourgeois estate Château de Marbuzet as a way of increasing the quality of the Grand Vin by being more selective in the vineyard and the winery.

Even though it still contains the fruit of younger vines, the average age of the vines that go into Les Pagodes des Cos is over 35 years. Reflective of the increasing acreage dedicated to Merlot at Cos d’Estournel, the percentage of Merlot in the final blend of Les Pagodes des Cos is usually notably high with some years (like 2015) even being Merlot-dominant.

While the Grand Vin of Cos d’Estournel will see anywhere from 60-80% new French oak, the second wine usually sees around 40%.

The 2017 vintage is a blend of 56% Cabernet Sauvignon, 42% Merlot, 1% Cabernet Franc and 1% Petit Verdot.

Critic Scores:

92-94 WE, 92-93 JS, 90-92 WA, 90-92 VM

Sample Review:

This is the second label of Cos d’Estournel, which accounted for about 55% of production in 2017. A blend of 56% Cabernet Sauvignon, 42% Merlot, 1% Cabernet Franc and 1% Petit Verdot, the 2017 Les Pagodes de Cos has a deep garnet-purple color and exuberant notes of crushed blackberries, red currants and cassis with touches of charcuterie, black soil and garrigue plus a waft of lavender. Medium-bodied and very fine-grained, it has great intensity and vibrancy with a good long, fruity finish. — Lisa Perrotti-Brown, Wine Advocate

Offers:

Wine Searcher 2017 Average $41

JJ Buckley: No offers yet

Vinfolio: No offers yet

Spectrum Wine Auctions: $257.94 for minimum 6 pack + shipping

Total Wine: $44.97

K & L: No offers yet

Previous Vintages:

2016 — Wine Searcher Ave. $47 Average Critic Score: 91 points

2015 — Wine Searcher Ave. $55 Average Critic Score: 91

2014 — Wine Searcher Ave. $47 Average Critic Score:91

2013 — Wine Searcher Ave. $44 Average Critic Score: 89

Buy or Pass?

The value of “second wines” is often hotly debated by Bordeaux fans with some folks feeling that they are overpriced for being “second best” while some feel they can offer exceptional bargains.

I tend to fall somewhere in the middle as I do think that Second Wines can offer terrific value and give the consumer a taste of the house-style of a great estate for a fraction of the price of the Grand Vin. However, I would never invest in cases of a second wine–especially if the Grand Vin of another estate is equivalent in value.

In my assessment of the offers for the 2017 Cos d’Estournel, I expressed my reservations on if the changing house style of the estate will still meet my tastes. While I’m not inclined to gamble at $150 a bottle (even if it is likely to be a 100 point wine that will increase in value), I’m perfectly willing to spend $45 a bottle on the second wine to get a window into Reybier’s style and what he did in this vintage. That makes the 2017 Les Pagodes a compelling Buy for me and worth taking a gamble on.

Ch. Phélan Ségur

Some Geekery:

In 1805, Bernard O’Phelan, an Irishman from Tipperary, began purchasing vineyards in St. Estephe–including parts that belonged to the historical Segur vineyard and Clos de Garramey–creating what would be the largest estate in St. Estephe at the time. Eventually his heirs sold the property and in it was acquired by Chaillou family in 1919.

In 1925, the estate was sold to Roger Delon, member of the notable family that now owns the 2nd Growth Léoville-Las-Cases, Château Nénin in Pomerol and the Medoc estate Ch. Potensac.

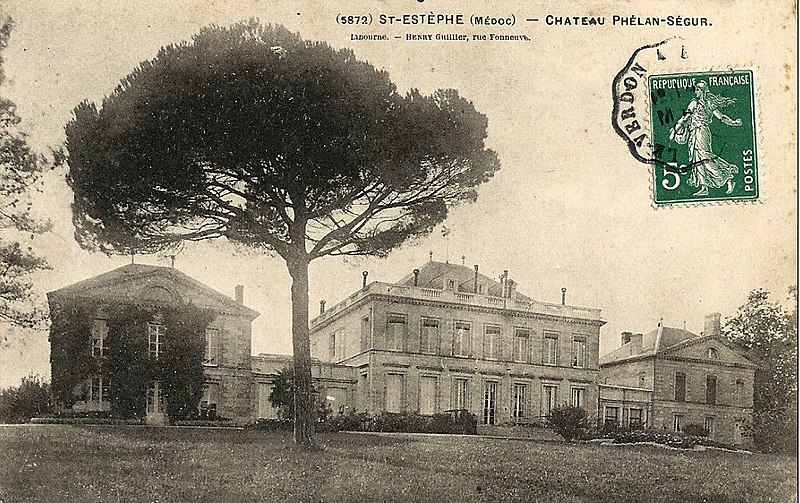

Postcard featuring Phélan Ségur in the early 1900s.

The Delons sold Phélan Ségur to Xavier Gardinier, the former head of the Champagne houses Pommery and Lanson, in 1985. When the 1983 vintage was released to poor reviews, Gardinier claimed the used of herbicides in the vineyards tainted the quality of the wine and he recalled all bottles from the marketplace.

The subsequent 1984 and 1985 vintages were likewise sold off in bulk and not released as Gardinier began a project of rehabilitation of the estate in the vineyard and winery. In 2002, he acquired Chateau Houissant next to the 2nd Growth estate Ch. Montrose, adding 25 hectares of prime vineyard land though 22 of those hectares would be eventually sold to Montrose in 2010. A few years later, in 2006, Michel Rolland was brought on as a consultant.

Phélan Ségur stayed in the Gardinier family, under the care of Thierry Gardinier, until 2017 when it was sold to Belgian businessman Philippe Van de Vyvere who formerly took over in January 2018.

The 2017 vintage is a blend of 65% Cabernet Sauvignon, 34% Merlot and 1% Cabernet Franc. Around 20,000 cases a year are produced.

Critic Scores:

92-93 WE, 92-93 JS, 90-93 VM, 89-92 Wine Spectator (WS), 89-92 JD

Sample Review:

The deep, saturated purple-colored 2017 Phélan Ségur is a classic, well-made wine in the vintage that has notable depth and density as well as textbook Saint-Estèphe notes of ripe black fruits, leafy herbs/tobacco, and loamy earth. It shows the fresher, cooler-climate style of the vintage yet is far from austere and has loads to love. — Jeb Dunnuck

Offers:

Wine Searcher 2017 Average $41

JJ Buckley: $43.94 + shipping

Vinfolio: No offers yet

Spectrum Wine Auctions: $251.94 for minimum 6 pack + shipping

Total Wine: $42.97

K & L: $42.99 + shipping

Previous Vintages:

2016 — Wine Searcher Ave. $48 Average Critic Score: 92 points

2015 — Wine Searcher Ave. $49 Average Critic Score: 91

2014 — Wine Searcher Ave. $45 Average Critic Score: 91

2013 — Wine Searcher Ave. $37 Average Critic Score: 88

Buy or Pass?

Phélan Ségur first landed on my radar with the surprisingly good 2013 and then the much better 2014 vintage. My experience with those two less-than-stellar vintages gave me ample confidence to purchase futures of the 2015 and 2016. But as reflective of my more cautious approach in 2017, I’m going to Pass on this year’s offering even though the $41 average price looks to be a solid value.

Change in the wine world is always inevitable–especially in Bordeaux–but when it comes to my wallet, I prefer to take a wait and see approach when it comes to changing ownership and winemakers. Besides, for a cru bourgeois like Phélan Ségur the risk of the retail price of the 2017 rising dramatically when it finally hits shelves in 2020 is fairly small. It might rise to the $45 average that the 2014 vintage is fetching now but it would probably require a major wine critic “re-evaluating” the bottle sample as a 94+ point wine for it to jump over $50 a bottle.

Ch. Calon-Ségur(St. Estephe)

Some Geekery:

While the Marquis de Ségur would own land that would become some of the most famous names in Bordeaux, the estate of Calon-Ségur was reportedly his favorite.

One of the oldest properties in the Medoc, the long history of Calon-Ségur can be traced to the 12th century when it belonged to the Monseigneur de Calon. The profile of the estate rose dramatically in the 18th century when it was owned by Nicolas Alexandre de Ségur, the Prince of Vines.

While the Marquis de Ségur would also go on to own an astonishing stable of estates, including 3 of the 5 First Growths–Lafite, Latour and Mouton–as well as land that is today part of Pontet-Canet, d’Armailhac and Montrose, it was said that his heart was always with his chateau at Calon in St. Estephe. That sentiment is reflected in the heart-shape logo of Calon-Ségur that still graces the label of the 3rd Growth today.

In 1894, the estate was purchased by negociant Charles Hanappier and Georges Gasqueton with Gasqueton’s descendants owning Calon-Ségur until 2012 when it was sold to a consortium that included the French insurance company Suravenir and Jean-Pierre Moueix, owner of Ch. Petrus. Flushed with capital, extensive renovations at the estate took place which included new tanks for parcel by parcel vinifications and the introduction of gravity-flow techniques. Vincent Millet, who previously was at Ch. Margaux, was kept as technical director.

In the vineyard, vine density was increased and under-performing parcels were uprooted with a goal of increasing the percentage of Cabernet Sauvignon in the cépage. While today the vineyard is planted to around 53% Cabernet Sauvignon 38% Merlot 7% Cabernet Franc and 2% Petit Verdot, eventually the owners of Calon-Ségur would like to see the amount of Merlot account for only 20% of plantings.

The 2017 vintage is a blend of 76% Cabernet Sauvignon, 13% Merlot, 9% Cabernet Franc and 2% Petit Verdot. Around 20,000 cases a year are produced.

Critic Scores:

95-97 WE, 94-95 JS, 92-94 WA, 92-94 VM, 91-94 WS, 92-94 JD, 94-96 JL

Sample Review:

Inky core with black-cherry rim. Ripe, dark and with a fine mineral cast to the cassis fruit, which is ripe but not sweet. Paper-fine tannins in many layers. Great ageing potential but also accessible. Deceptively accessible, suggesting lack of ageing ability, but I don’t think that is the case. Cool, fresh, serious, fine cassis fruit. The finesse comes from the lack of sweetness but there’s no lack of fruit. Dry, firm and very St-Estèphe, with tannin structure. But the structure is filled molecule by molecule with the fruit. It’s so finely balanced. There’s more firmness than in Cos but there’s still excellent harmony. Opens to a hint of violets. Super-moreish and juicy even with the structure of the terroir. (17.5 out of 20) Julia Harding, JancisRobinson.com

Offers:

Wine Searcher 2017 Average $85

JJ Buckley: $87.94 + shipping

Vinfolio: $88 + shipping

Spectrum Wine Auctions: No offers yet

Total Wine: $84.97

K & L: $89.99 + shipping

Previous Vintages:

2016 — Wine Searcher Ave. $118 Average Critic Score: 95 points

2015 — Wine Searcher Ave. $106 Average Critic Score: 93

2014 — Wine Searcher Ave. $101 Average Critic Score: 94

2013 — Wine Searcher Ave. $101 Average Critic Score: 92

Buy or Pass?

I was very surprised to have the 2003 Calon Segur be one of my Top 10 wines from the 2017 Wine Spectator Grand Tour.

But even at nearly 14 years of age, this “heat wave” Bordeaux was showing beautifully.

I’ve adored numerous vintages of Calon-Ségur from the still lively 1996 (ave price $138), surprisingly complex 2003 (ave $128), undoubtedly excellent 2009 (ave $130) and the very promising 2012 (ave $105) and 2014.

While I’ve not yet purchased any futures from the estate, my experience particularly with the later two vintages has given me enough assurance in the stewardship of the new ownership team that this will likely continue being a style of wine that I enjoy. Plus with the value of Calon-Ségur rising north of $100 even in sub-par vintages like 2013, makes nabbing bottles of the 2017 at $85 an extremely compelling value and a definite Buy.

More Posts About the 2017 Bordeaux Futures Campaign

*Bordeaux Futures 2017 — Langoa Barton, La Lagune, Barde-Haut, Branaire-Ducru

*Bordeaux Futures 2017 — Pape Clément, Ormes de Pez, Marquis d’Alesme, Malartic-Lagraviere

*Bordeaux Futures 2017 — Lynch-Bages, d’Armailhac, Clerc-Milon and Duhart-Milon

*Bordeaux Futures 2017 — Clos de l’Oratoire, Monbousquet, Quinault l’Enclos, Fonplegade

*Bordeaux Futures 2017 — Clinet, Clos L’Eglise, L’Evangile, Nenin

Bordeaux Futures 2017 — Malescot-St.-Exupéry, Prieuré-Lichine, Lascombes, Cantenac-Brown

*Bordeaux Futures 2017 — Beychevelle, Talbot, Clos du Marquis, Gloria

*Bordeaux Futures 2017 — Beau-Séjour Bécot, Canon-la-Gaffelière, Canon, La Dominique

*Bordeaux Futures 2017 — Vieux Chateau Certan, La Conseillante, La Violette, L’Eglise Clinet

*Bordeaux Futures 2017 — Montrose, La Dame de Montrose, Cantemerle, d’Aiguilhe

*Bordeaux Futures 2017 — Clos Fourtet, Larcis Ducasse, Pavie Macquin, Beauséjour Duffau-Lagarrosse

*Bordeaux Futures 2017 — Kirwan, d’Issan, Brane-Cantenac, Giscours