Continuing our series on the 2017 Bordeaux Futures campaign, I’m taking a look at offers featuring the Pessac-Léognan estates of Ch. Pape Clément and Malartic-Lagraviere, the St. Estephe Cru Bourgeois Ormes de Pez and the 3rd Growth Margaux estate Marquis d’Alesme.

For my general approach to buying futures for the 2017 vintage and my thoughts on earlier offers, check out my post Bordeaux Futures 2017 — Palmer, Valandraud, Fombrauge, Haut-Batailley.

Pape Clément (Pessac-Léognan)

Brief winery geekery:

One of the oldest estates in Bordeaux with a history dating back to the 13th century. In 1305, the Archbishop of Bordeaux, Bertrand de Goth was elected pope (taking the name Clement V) and was gifted the property in Pessac-Léognan. The property remained in the hands of the Archbishops of Bordeaux until the end of the 18th century when many ecclesiastical properties were confiscated by the French government.

In 1980 Bernard Magrez, an entrepreneur who worked as a negociant for the Cordier group, acquired sole control of the estate from the two families who shared ownership (which included his wife). In 1993, he brought in Michel Rolland as a consultant. The style of Pape Clément during this period has been distinguished by its use of 100% new French oak.

The estate is located very close to the city of Bordeaux with the First Growth estate Ch. Haut-Brion being the closest vineyard neighbor. Both red and white grapes are planted with the vineyard spread of red varieties being 60% Cabernet Sauvignon and 40% Merlot. Around 7,500 cases a year of the red Grand Vin are produced.

Ch. Pape-Clement

The 2017 vintage is a blend of 55% Cabernet Sauvignon and 45% Merlot.

Critic scores:

94-97 Antonio Galloni (AG), 95-96 James Suckling (JS), 92-94 Wine Advocate (WA), 91-94 Wine Spectator (WS), 90-92 Wine Enthusiast (WE), 94-96 Jeb Dunnuck (JD), 95-97 Jeff Leve (JL)

Sample review:

The 2017 Pape Clément is fabulous. One of the rare 2017s with a real sense of structure, Pape Clément possesses dazzling intensity from start to finish. A rush of dark cherry, plum, chocolate and grilled herb notes hits the palate as this majestic, towering wine shows off its personality. Time in the glass brings out a brighter and more floral set of flavors. The 2017 is the first vintage made with a portion of whole clusters, an inspiration Bernard Magrez takes from Châteauneuf-du-Pape, where he recently bought a small property. Quite simply, the 2017 Pape Clément is a magnificent wine by any measure. Don’t miss it. The only problem with the 2017 is that yields are down 40% because of frost. — Antonio Galloni, Vinous

2017 Wine Searcher Average Price: $88

JJ Buckley: $89.94 + shipping (no shipping if picked up at Oakland, CA location)

Vinfolio: $95 + shipping

Spectrum Wine Auctions: $87.99 + shipping (no shipping if picked up at Tustin, CA location)

Total Wine: $89.97 (no shipping/sent to local store)

K&L: $94.99 + shipping (no shipping if picked up at K & L locations in California)

Previous Vintages:

2016 — Wine Searcher Average $ 99 Average Critic Score: 92 pts

2015 — Wine Searcher Average $ 116 Average Critic Score: 94 pts

2014 — Wine Searcher Average $ 96 Average Critic Score: 93 pts

2013 — Wine Searcher Average $ 89 Average Critic Score: 91 pts

Buy or Pass?

To my taste, the style of Pape Clément is very New World-ish which has me comparing its value more to high-end Napa Valley than necessarily to its Bordelais peers. That said, I usually find the wine delivering ample hedonistic pleasure that I would put on par with Napa wines in the $150+ range. This is never a wine that I buy more than a couple bottles of as I’m skeptical about the long term aging potential with this lush, velvety style.

Still, I’m impressed that the average futures price is more inline with the sub-par 2013 vintage–even with the drastically reduced case production. As I noted in my last 2017 Bordeaux Futures post, my objective this campaign is to look for value and “cellar defenders”. To that extent the Pape Clément is compelling enough to be a Buy for me.

Ormes de Pez (St. Estephe)

Brief winery geekery:

The author and her wife with Jean-Michel Cazes.

Cru Bourgeois estate founded in the 16th century in the northwestern part of St. Estephe near Ch. de Pez and Ch. Château Beau-Site Haut-Vignoble. Since 1940, the estate has been owned by the Cazes family who also own the 5th Growth Pauillac estate Ch. Lynch-Bages with the same viticulture and winemaking teams used at both estates.

The vineyard soils are a mix of gravel with high percentages of clay and sand. To optimize the terroir, the Cazes family has been steadily increasing the amount of Merlot planted on the clay dominant parcels with the estate being planted to around 50% Cabernet Sauvignon, 33% Merlot, 10% Cabernet Franc and 2% Petit Verdot. Around 18,000 cases a year are produced.

The 2017 vintage is 51% Merlot dominant, 42% Cabernet Sauvignon, 6% Cabernet Franc and 1% Petit Verdot.

Critic scores:

92-93 JS, 91-93 AG, 88-91 WS, 91 -93 WE, 89-91 JD, 88-90 JL

Sample review:

Ormes has managed another good vintage after a run of them. This is a lovely wine and a buy for me. Succulent, bristling and charming, it has juicy brambled fruit extraction and tension. It doesn’t take itself too seriously, just asking to be loved. The fruit spectrum is rich with blueberries and damsons, with integrity and a swirl of vanilla bean oak. Includes 6% Cabernet Franc in the blend. No need to wait too long for this. 45% new oak. (92 pts) — Jane Anson, Decanter

2017 Wine Searcher Average Price: $28

JJ Buckley: No offers yet

Vinfolio: No offers yet

Spectrum Wine Auctions: $179.94 minimum 6 bottle purchase + shipping.

Total Wine: $29.97

K&L: $29.99 + shipping

Previous Vintages:

2016 — Wine Searcher Average $ 34 Average Critic Score: 91 pts

2015 — Wine Searcher Average $ 35 Average Critic Score: 90 pts

2014 — Wine Searcher Average $ 34 Average Critic Score: 90 pts

2013 — Wine Searcher Average $ 27 Average Critic Score: 88 pts

Buy or Pass?

I was impressed with how well the 2011 Ormes de Pez was showing despite that vintage being much more promblematic than 2017. That gives me a lot of optimism about the quality level that the Cazes family will deliver.

At around $30 a bottle, this looks like the quintessential “Cellar Defender” that will offer short term pleasure and guilt-free enjoyment which will help me keep my paws off of my 2015/16 Bordeaux. This is a good Buy for me, even with a 6 bottle minimum purchase.

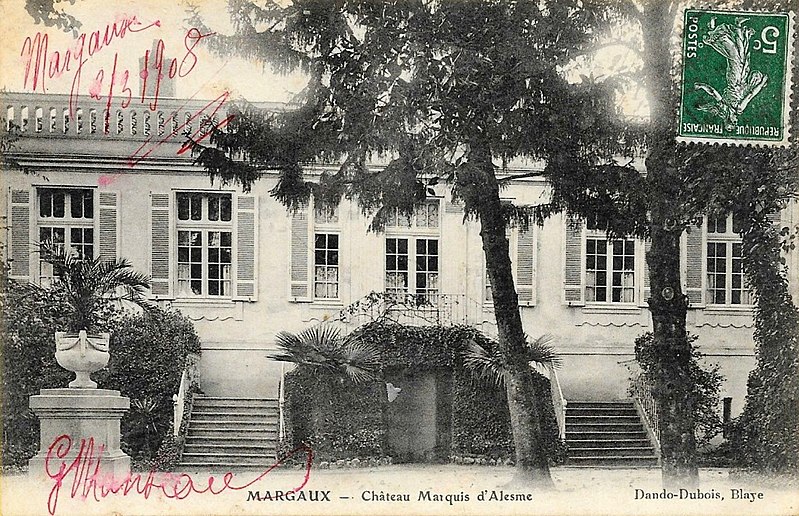

Old postcard featuring the exterior of Ch. Marquis d’Alesme circa 1900-1920.

Marquis d’Alesme (Margaux)

Brief winery geekery:

Third Growth Margaux estates founded in 1585 in the northern part of the commune near Ch. Margaux, Ch. Malescot St. Exupéry and Ch. Ferrière.

In 2006, the property was sold by the Zuger family (who own Malescot St. Exupery) to Hubert Perrodo who also owned the Cru Bourgeois Margaux estate Ch. Labegorce. Following Hubert’s death after a skiing accident, both estates have been ran by his daughter Nathalie Perrodo.

The estate owns three parcels of vineyards, including a significant section close to the D2 road on silica and gravel soils. In recent years, plantings of Cabernet Sauvignon and Cabernet Franc have been increased with the current vineyard mix being around 63% Cabernet Sauvignon, 30% Merlot, 5% Petit Verdot and 2% Cabernet Franc. About 7000 cases a year are produced.

The 2017 vintage of Marquis d’Alesme is a blend of 61% Cabernet Sauvignon, 33% Merlot and 6% Petit Verdot.

Critic scores:

92-94 WA, 92-94 AG, 90-93 WS, 91-92 JS, 91-93 JL

Sample review:

The wine quickly shows off its floral essence with black cherry and spice box notes. Sweet and fresh, the wine is full bodied, soft, refined and displays its freshness and ripe cherries with a bit of cocoa just as you approach the endnote. The wine reached 13.5% alcohol. — Jeff Leve, The Wine Cellar Insider

2017 Wine Searcher Average Price: $39

JJ Buckley: No offers yet.

Vinfolio: No offers yet

Spectrum Wine Auctions: No offers yet

Total Wine: $41.97

K&L: $40.99 + shipping

Previous Vintages:

2016 — Wine Searcher Average $ 42 Average Critic Score: 91 pts

2015 — Wine Searcher Average $ 49 Average Critic Score: 92 pts

2014 — Wine Searcher Average $ 43 Average Critic Score: 91 pts

2013 — Wine Searcher Average $ 36 Average Critic Score: 89 pts

Buy or Pass?

Compared to the 2014 (and even 2016) vintage, this does look like a decent value. But I must confess that I’ve never been terribly wowed by Marquis d’Alesme in the past. While in vintages like 2015/16, I’d be more willing to give an estate a flyer or another look, for 2017 I’m leaning more towards estates that I have a track record of enjoying.

Truthfully, I’ve founded the Perrodo’s Cru Bourgeois estate Ch. Labegorce to be a much better value in the $29-33 range. I’m more incline to investigate JJ Buckley, Spectrum, Total Wine and K & L’s offers on that wine and Pass on the Marquis d’Alesme.

The calm before the storm at the UGC tasting for the 2014 vintage in Miami, FL.

Malartic-Lagraviere (Pessac-Léognan)

Brief winery geekery:

This Graves estate was originally known as Domaine de Lagraviere until the Malartic family changed the name in 1850 to honor Comte Anne-Joseph-Hippolyte Maures de Malartic who was a notable Admiral in the French Navy. The boat featured on the wine label also pays tribute to this heritage. In 1990, the estate was purchased by the Champagne house Laurent-Perrier who later sold it to the Bonnie family in 1997.

The Bonnies have modernize the facilitaties and introduced sustainable farming to the vineyards. The terroir of their 53 hectares (located near Domaine de Chevalier and Ch. de Fieuzel) includes deep gravelly soils that can be as deep as 8 meters in the parcels near the Chateau. The vineyards are planted to 45% Merlot, 45% Cabernet Sauvignon, 8% Cabernet Franc and 2% Petit Verdot.

The 2017 vintage is a blend of 65% Cabernet Sauvignon, 30% Merlot, 3% Petit Verdot and 2% Cabernet Franc

Critic scores:

94-96 WE, 92-93 JS, 90-93 WS, 90-93 AG, 89-91 WA, 92-94 JL, 89-91 JD

Sample review:

Deep crimson. Dark, nicely dusty cassis. Dark chocolate and graphite finesse. Dry, fine tannins with the graphite freshness marked on the finish. Elegant, if not charming at the moment. Attractive restraint. (16.5 out of 20)– Julia Harding, Jancis Robinson’s Purple Pages

2017 Wine Searcher Average Price: $47

JJ Buckley: $49.94 + shipping

Vinfolio: No offers yet

Spectrum Wine Auctions: No offers yet

Total Wine: $49.97

K&L: $49.99 + shipping

Previous Vintages:

2016 — Wine Searcher Average $ 59 Average Critic Score: 91 pts

2015 — Wine Searcher Average $ 61 Average Critic Score: 94 pts

2014 — Wine Searcher Average $ 51 Average Critic Score: 92 pts

2013 — Wine Searcher Average $ 41 Average Critic Score: 90 pts

Overall I was fairly impressed with the 2013 and 2014 from Pessac-Leognan at the UGC tastings but for 2017 I’m more incline to buy in for estates like Domaine de Chevalier (pictured) .

Buy or Pass?

This is another estate that looks to be offering decent value but is one that I just don’t have a strong personal track record with. My most recent tastings of Malartic-Lagraviere were at Union des Grands Crus de Bordeaux events for the 2014 and 2013 vintages and while I found the wines well-made, there was nothing spectacular about them either. My notes for the 2014, in particular, highlighted how tight the 2014 was and that it would need far more time than what I typically anticipate for a “Cellar Defender”.

As a futures offering, I’m going to Pass on the Malartic-Lagraviere but would certainly be open to tasting it in the bottle at a future UGC tasting and perhaps buying in then if the prices still remain compelling as a good value.

More Posts About the 2017 Bordeaux Futures Campaign

*Bordeaux Futures 2017 — Langoa Barton, La Lagune, Barde-Haut, Branaire-Ducru

*Bordeaux Futures 2017 — Lynch-Bages, d’Armailhac, Clerc-Milon and Duhart-Milon

*Bordeaux Futures 2017 — Clos de l’Oratoire, Monbousquet, Quinault l’Enclos, Fonplegade

*Bordeaux Futures 2017 — Cos d’Estournel, Les Pagodes des Cos, Phélan Ségur, Calon-Segur

*Bordeaux Futures 2017 — Clinet, Clos L’Eglise, L’Evangile, Nenin

Bordeaux Futures 2017 — Malescot-St.-Exupéry, Prieuré-Lichine, Lascombes, Cantenac-Brown

*Bordeaux Futures 2017 — Beychevelle, Talbot, Clos du Marquis, Gloria

*Bordeaux Futures 2017 — Beau-Séjour Bécot, Canon-la-Gaffelière, Canon, La Dominique

*Bordeaux Futures 2017 — Vieux Chateau Certan, La Conseillante, La Violette, L’Eglise Clinet

*Bordeaux Futures 2017 — Montrose, La Dame de Montrose, Cantemerle, d’Aiguilhe

*Bordeaux Futures 2017 — Clos Fourtet, Larcis Ducasse, Pavie Macquin, Beauséjour Duffau-Lagarrosse

*Bordeaux Futures 2017 — Kirwan, d’Issan, Brane-Cantenac, Giscours

Continuing our celebration of the oddly named

Continuing our celebration of the oddly named

Going to need more than

Going to need more than